Retirement Planning | Generate Retirement Income

Any successful journey requires detailed planning. When the stakes are high, winging it isn’t an option. We start with our proprietary Stenger Retirement Planning Process.

5 Steps to a Successful Retirement

Our proprietary 5-Step Retirement Navigation Process starts with an assessment of your future goals. Your Stenger financial advisor will take an inventory of your income, projected retirement expenses, assets and liabilities and create a customized financial plan that addresses your specific needs. Because Stenger Family Office operates as a multi-family office, our financial advisors will work directly with our in-house team of accountants and estate planning attorneys to create a comprehensive plan that addresses all aspects of your financial life.

Step #1:

Income & Expenses

Retirement planning solves the key problem of paying expenses on a fixed income. Your Stenger Financial Advisor will add up your expected income, subtract your monthly expenses, calculating your retirement income gap. This income gap will be compared against your assets and liabilities to determine if you have enough saved to retire.

Step #2:

Assets & Liabilities

After calculating your annual retirement income gap, your Stenger financial advisor will take an inventory of your investable assets and the potential amount of additional income these assets can generate. In general, we want our clients to be as debt free as possible approaching retirement.

Step #3:

Investment Management

Many investment portfolios are created with a risk questionnaire, asking investors how much risk they can tolerate. While this is an important component of portfolio construction, we believe investors should implement a goals-based financial plan, not risk-based. A goals based plan helps you address the most important question - “Will I run out of money during retirement?”

Step #4:

Tax Strategy

Often times, tax planning and strategy go overlooked when creating a financial plan. While there are no quick and easy ways to save money on taxes in any given year, there are substantial savings that can be achieved through long range tax planning and preparation. As a multi-family office, we employ an in-house team of accountants and CPAs to create a tax efficient plan alongside your financial advisor.

Step #5:

Estate Planning

Passing down your assets and legacy to the next generation is an important component of retirement planning. At the very least, not leaving a mess to your children and grandchildren can be achieved through thoughtful estate planning strategies coordinated alongside your financial and tax strategies.

Stenger Retirement Planning Process

Your Customized Retirement Plan

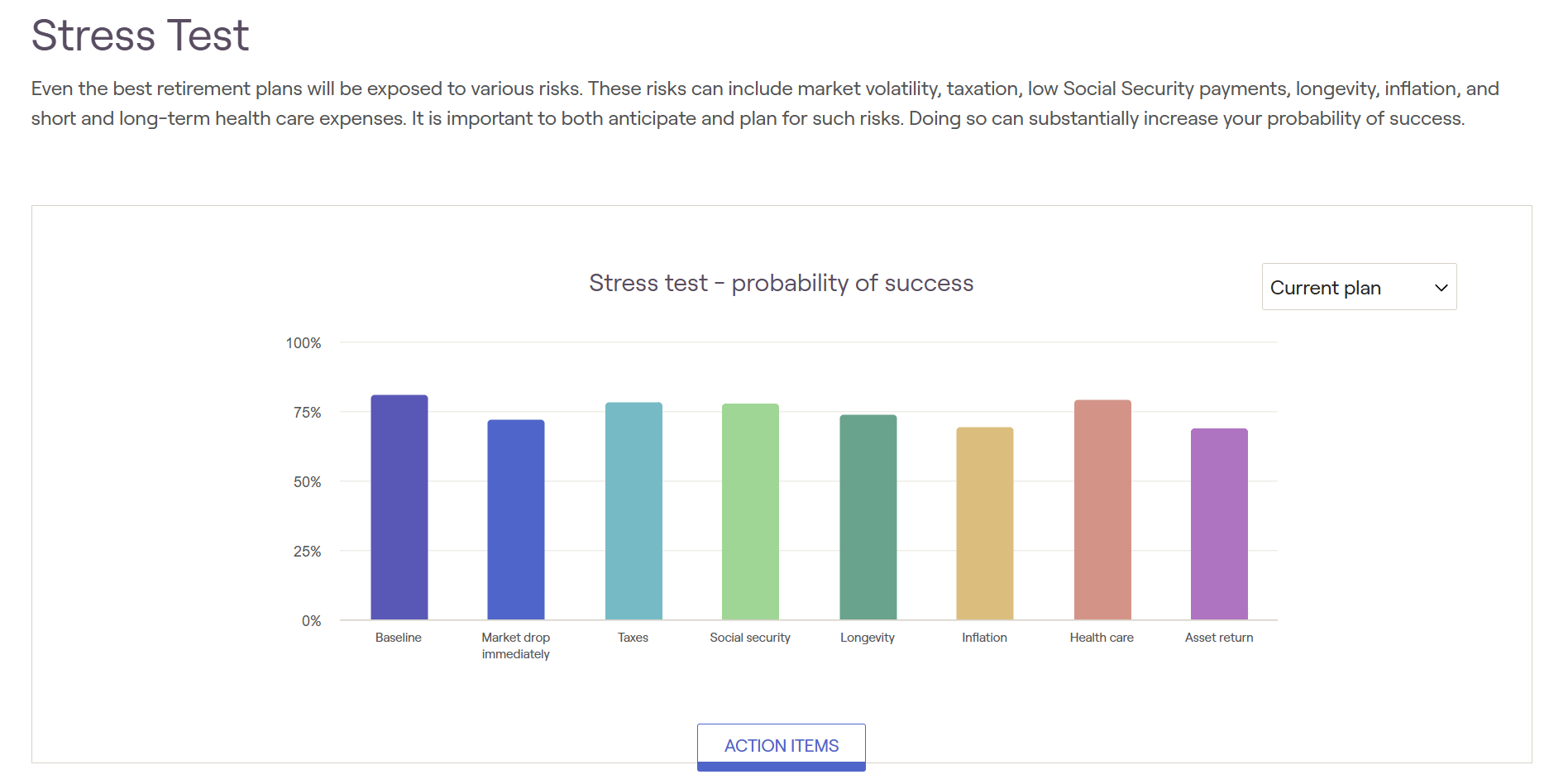

Stenger Family Office financial advisors will help you create a plan that achieves your goals and has a high chance of success given a variety of potential market environments.

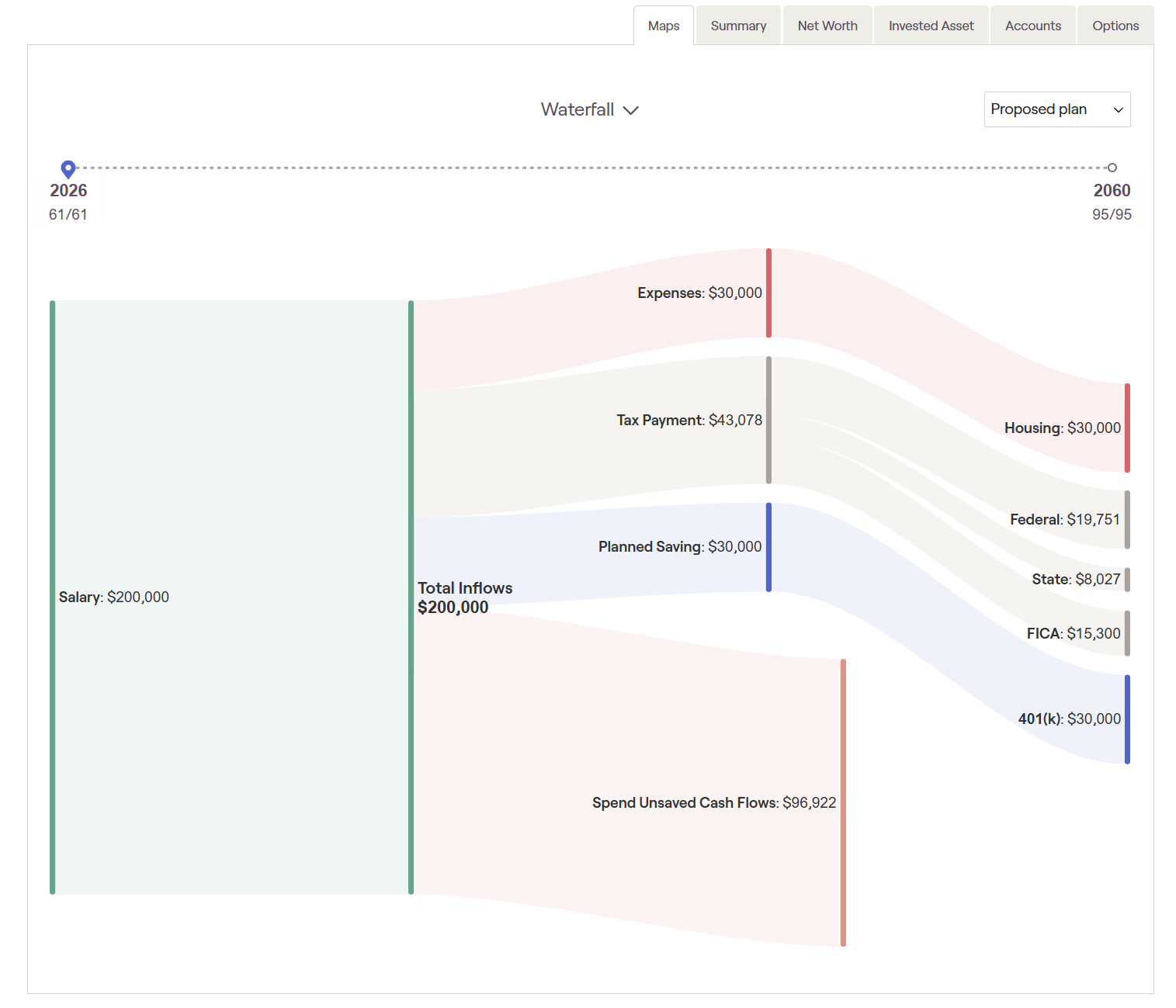

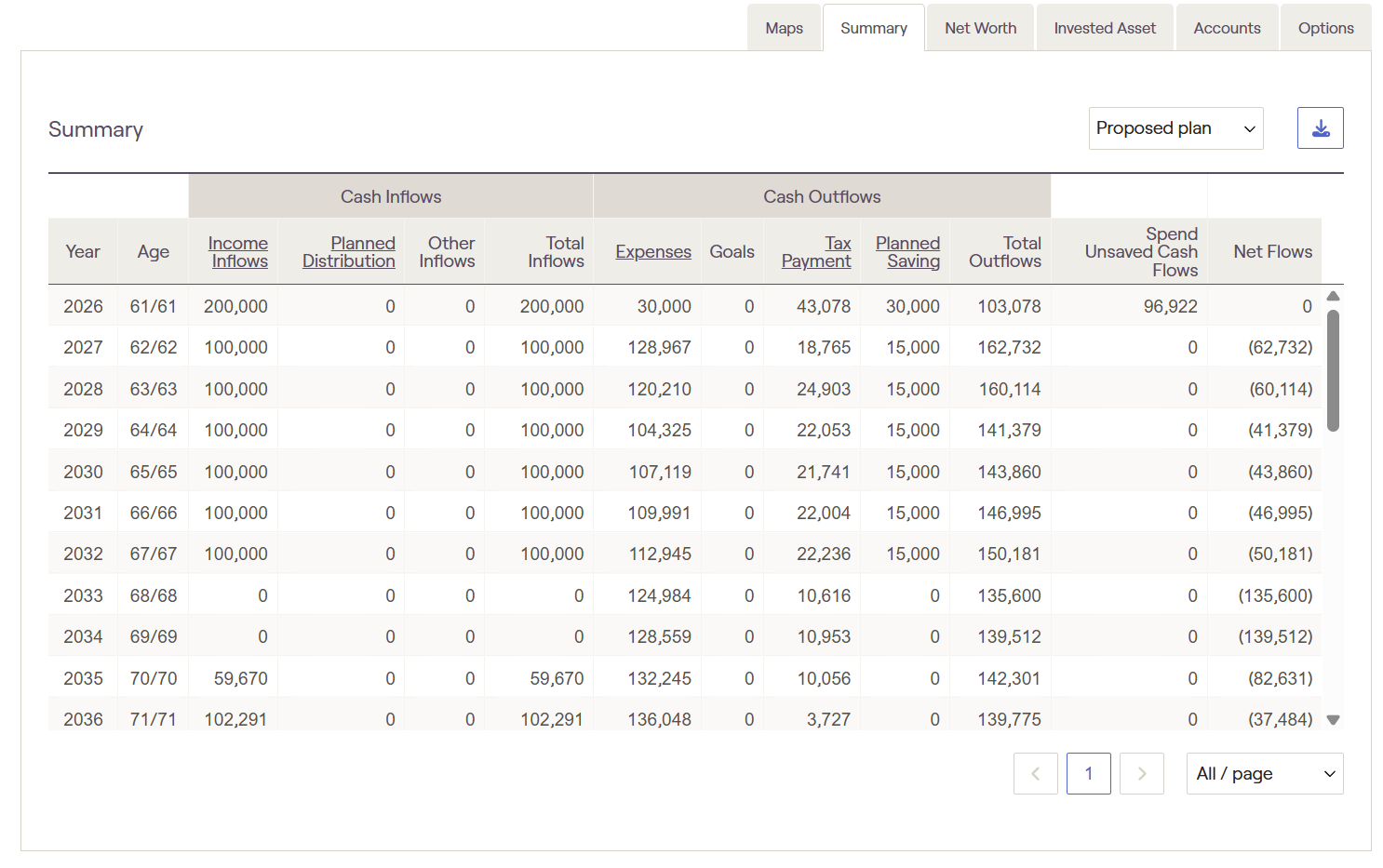

Our retirement process begins with an inventory of your assets, liabilities, income and expenses, and what we expect you’ll need to maintain your lifestyle and accomplish your goals during retirement. The most important part of retirement planning is developing your plan to generate income from investments and other fixed sources.

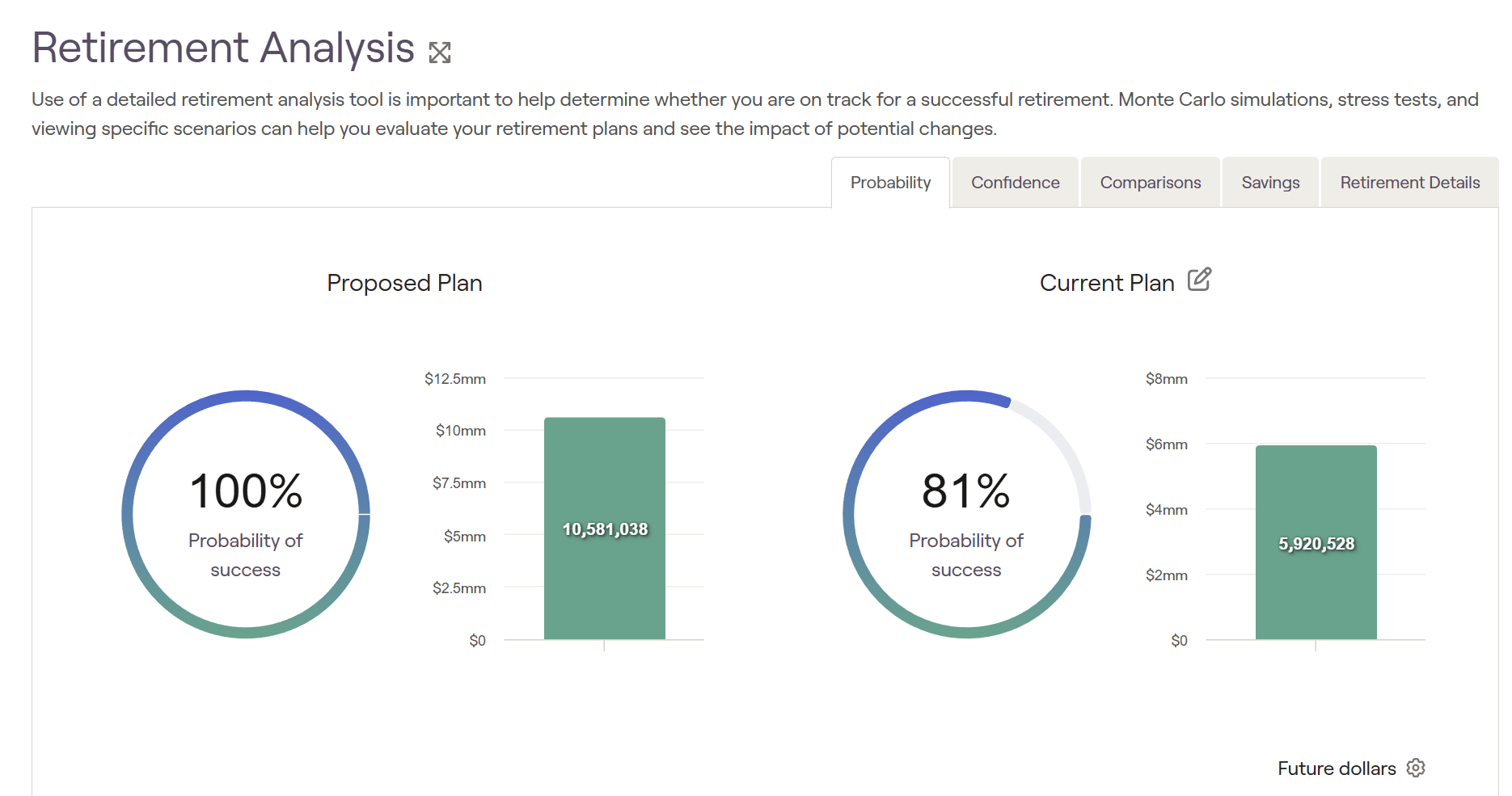

The screenshot above is an example of a Monte-Carlo simulation, taking into account return assumptions, sequence of returns in retirement, and a variety of other factors. Stenger financial advisors will build your investment plan based on what your goals based plan calls for. We do not build risk based investment portfolios, but rather goals based portfolios that align with your needs.

Retirement Cash Flow Projections

Retirement cash flow planning is the process of making sure your money lasts as long as you do. Instead of focusing only on how much you save, it looks at how income and expenses will line up month by month and year by year once you stop working. Good planning helps retirees maintain their lifestyle, handle surprises, and reduce stress about running out of money.

1. Understanding Retirement Expenses

The first step is estimating expenses. Some costs may drop in retirement, such as commuting or work-related spending, while others often rise, especially healthcare, insurance, and leisure activities. Expenses usually change over time:

Early retirement: Travel and hobbies may increase spending.

Mid-retirement: Spending often stabilizes.

Later years: Healthcare and support costs may grow.

Planning for these phases makes cash flow more realistic.

2. Identifying Income Sources

Retirement income usually comes from multiple sources, such as:

Pensions or annuities

Government benefits (like Social Security, depending on country)

Investment withdrawals (stocks, bonds, mutual funds)

Part-time work or rental income

Each source has different timing, reliability, and tax treatment, which affects how cash flows throughout the year.

3. Matching Income to Expenses

A key goal is to align reliable income with essential expenses (housing, food, utilities, healthcare). Guaranteed or predictable income is best used to cover necessities, while more flexible or variable income can fund discretionary spending like travel or hobbies.

4. Withdrawal Strategies

For investments, deciding how much to withdraw and when is critical. Withdrawing too much early can increase the risk of running out of money later. Common strategies include:

Using a percentage-based withdrawal

Drawing from taxable accounts first, then tax-deferred accounts

Keeping short-term spending money in safer assets to avoid selling investments during market downturns

5. Managing Risks

Retirement cash flow planning must account for risks such as inflation, market volatility, and longer-than-expected lifespan. Diversifying income sources, adjusting spending when needed, and reviewing the plan regularly help manage these risks.

6. Ongoing Review and Adjustment

Retirement is not static. Expenses, health, markets, and personal goals change over time. Reviewing cash flow plans regularly ensures they stay aligned with reality and allows for timely adjustments.

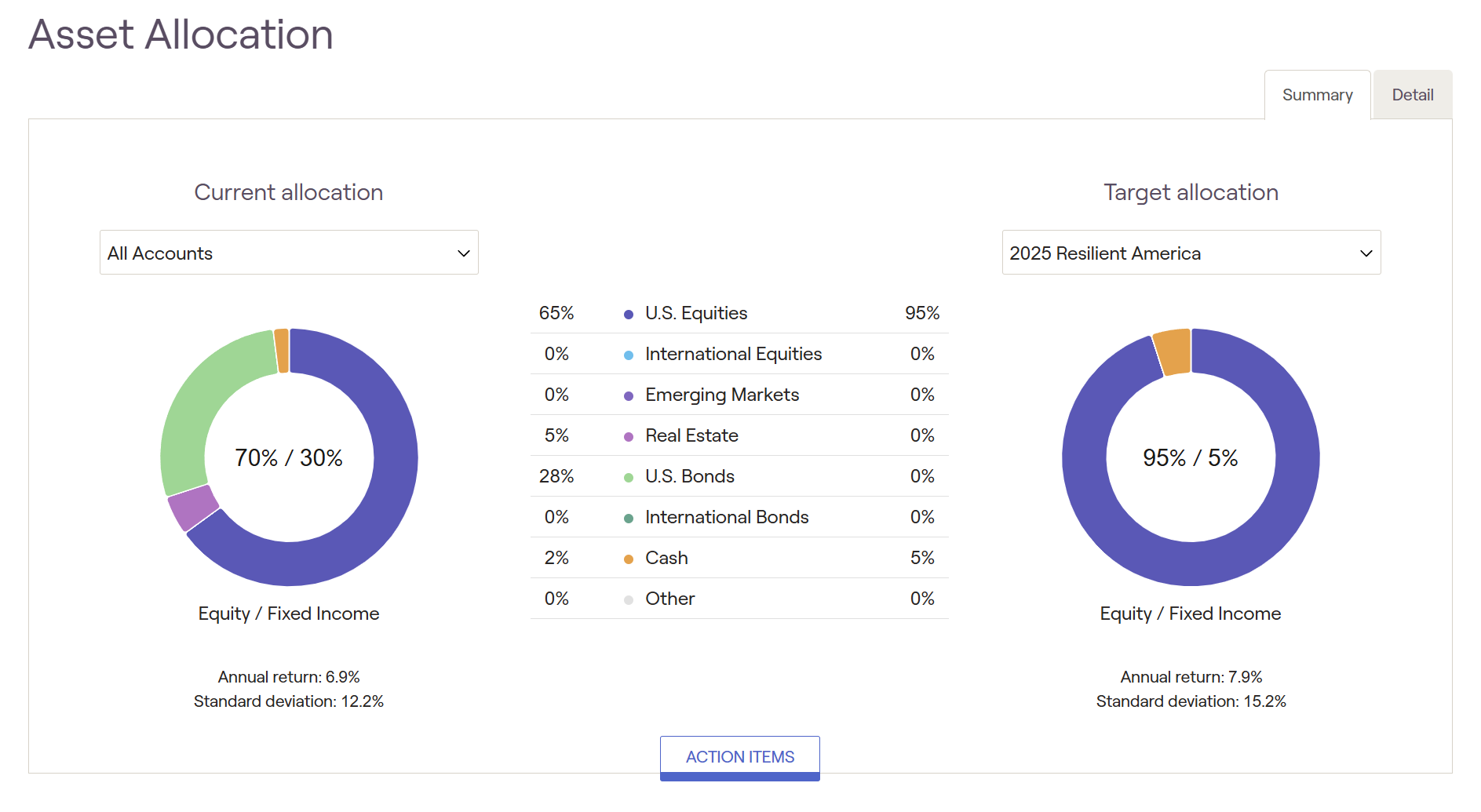

Investing During Retirement

Asset allocation during retirement is the strategy of dividing investments among different asset classes—such as stocks, bonds, and cash—to balance growth, income, and risk. While accumulation years focus heavily on growth, retirement requires a more balanced approach that supports regular income while protecting against market downturns and inflation.

1. Shifting Goals in Retirement

In retirement, the primary investment goals usually include:

Generating reliable income

Preserving capital

Maintaining enough growth to outpace inflation

Because retirees are drawing from their portfolios, large market losses can be harder to recover from than during working years.

2. Role of Major Asset Classes

Equities (stocks): Provide long-term growth and inflation protection. Even in retirement, holding some equities is important to support longer life spans.

Fixed income (bonds): Offer income and stability, helping reduce portfolio volatility.

Cash and cash equivalents: Provide liquidity for near-term expenses and help avoid selling investments during market downturns.

Alternative assets (optional): Real estate or other alternatives can add diversification, but they should be used carefully due to liquidity and risk considerations.

3. Time-Based Allocation Approach

Many retirees use a “bucket” or time-segmentation strategy:

Short-term bucket: Cash and short-term bonds to cover 1–3 years of expenses.

Mid-term bucket: Bonds and conservative investments for the next several years.

Long-term bucket: Growth-oriented assets like stocks for later retirement years.

This approach helps match assets to spending timelines and reduce emotional reactions to market swings.

4. Managing Sequence-of-Returns Risk

Poor market returns early in retirement can significantly impact long-term outcomes. To manage this risk, retirees often:

Keep sufficient safe assets for early withdrawals

Adjust spending during market downturns

Rebalance portfolios regularly to maintain target allocations

5. Adjusting Asset Allocation Over Time

Asset allocation in retirement is not static. As retirees age, they may gradually reduce risk, but this should be balanced against the need for growth. Regular reviews help ensure the portfolio still aligns with spending needs, health, and life expectancy.

6. Tax Considerations

Different asset classes may be better suited for different account types. For example, income-producing assets may fit better in tax-deferred accounts, while growth assets may be more efficient in taxable accounts. Thoughtful placement can improve after-tax cash flow.

Meet the Financial Advisors

-

Nick Stenger

CEO & Financial Advisor

Nick Stenger is the Chief Executive Officer and financial advisor at Stenger Family Office. Nick is a 7th generation Naperville, IL resident where he lives with his wife Jamie and son Jack. Prior to launching Stenger Family Office, Nick was a Senior Vice President and financial advisor at Morgan Stanley Wealth Management. Nick helped lead the team’s growth to become one of Morgan Stanley’s largest wealth management teams. In 2023, Nick and the team were named one by Forbes as a Best-In-State Wealth Management team in Illinois. Prior to Morgan Stanley, Nick worked at Invesco PowerShares, a $1 trillion asset manager in Atlanta, GA and PricewaterhouseCoopers, LLP (PwC) in Chicago, IL. Nick is a graduate of the Quinlan School of Business at Loyola University Chicago with degrees in accounting and finance.

-

Chris Jordan, CPA, MST

Chief Financial Officer

Chris Jordan is Chief Financial Officer and Head of Tax at Stenger Family Office. Chris leads the Stenger tax team and assists family office clients with tax preparation and advisory services.

Chris is a Certified Public Accountant and specializes in business tax preparation, individual tax preparation, partnerships, estate taxation, and high net worth family taxes. Prior to Stenger Family Office, Chris was a Tax Manager at Porte Brown, a midsize accounting firm in the Chicago suburbs.

Chris earned his BA in Accounting from Augustana College and his Masters of Science in Taxation from the Carl H. Lindner College of Business at the University of Cincinnati.

-

Audrey Feldpausch, CFP®

Vice President, Financial Advisor

Audrey Feldpausch is a Vice President and Financial Advisor with Stenger Family Office. Audrey leads the team’s financial planning practice and also is a member of the Stenger Family Office Investment Committee. Audrey is a CERTIFIED FINANCIAL PLANNER™ and completed her CFP® training through Northwestern University in Chicago, IL. Prior to Stenger Family Office, Audrey worked at UBS Wealth Management and Timothy Financial, a financial planning firm in the Chicago suburbs. Audrey is a graduate of Hillsdale College where she earned her B.A. in Economics. Audrey and her husband live in the Chicagoland area.

Our multi-family office approach helps simplify and organize your financial life.

Our Office Locations

-

Naperville Financial Advisor

Naperville Financial Center

400 E. Diehl Road

Suite 550

Naperville, IL 60563 -

Chicago Financial Advisor

150 N. Riverside Plaza

Suite 1950

Chicago, IL 60606 -

Houston Financial Advisor

City Place

1700 City Plaza Drive

Suite 440

Spring, TX 77389 -

Baton Rouge Financial Advisor

City Plaza

445 North Blvd

Suite 570

Baton Rouge, LA 70802

Fiduciary Financial Advisor Naperville, Chicago, Houston & Baton Rouge.

Take the next step with our team of experienced financial advisors, financial planners, tax accountants, estate planning attorneys and insurance specialists. The first step in the Stenger Retirement Planning Process is to create a comprehensive financial plan. We can meet with you in-person at our local Naperville, IL, Houston, TX, Baton Rouge, LA offices or at a location that works best for you.

Contact Us

Naperville Financial Advisor

400 E. Diehl Road

Suite 550

Naperville, IL 60563

Chicago Financial Advisor

150 N. Riverside Plaza

Suite 1950

Chicago, IL 60606

Houston Financial Advisor

1700 City Plaza Drive

Suite 440

Spring, TX 77389

Baton Rouge Financial Advisor

445 North Blvd

Suite 570

Baton Rouge, LA 70802

Phone

(630) 912-8431